Call Now For Your Free Quote 👉

Expert Real Estate Development Analysis & Consulting

Expert Real Estate Development Consulting – In-depth guidance from project feasibility to capital structuring.

Wall Street-Backed Financial Expertise – Over a decade of investment banking and capital markets experience.

Comprehensive Project Analysis – Beyond basic reports, we provide strategic insights to maximize your project’s success.

Get Your Free Quote

Get Your Free Consultation

NOTE: We are not currently hiring, please do not submit if you are looking for work. Nosotros no estamos contratando.

Creating Real Value in Property and Places

Without costing an arm and a leg.

Take a look at some of our recent work. We can bring your most intricate visions to life.

Creating Real Value In Property And Places

Without costing an arm and a leg.

Take a look at some of our recent work. We can bring your most intricate visions to life.

Real Estate Development Advisory – Strategic Planning for Developers

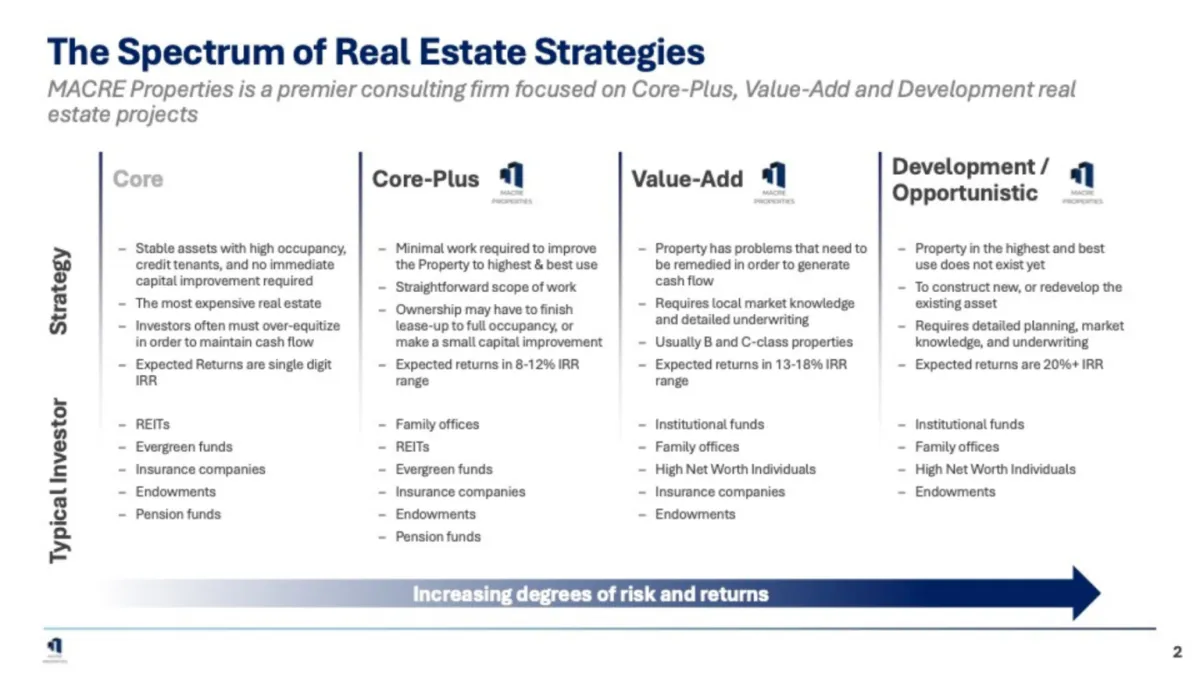

Navigating the complexities of real estate development requires expert guidance. We provide tailored advisory services for developers seeking strategic planning, feasibility assessments, and financial structuring for multi-residential, hospitality, office, mixed-use, and redevelopment projects.

✅ Feasibility & Market Analysis – Validate project potential with data-driven insights.

✅ Capital Structuring & Investment Strategy – Secure the right financing for your development.

✅ Project Execution & Risk Management – Ensure smooth development with expert oversight.

📞 Call today to discuss your next development project!

Real Estate Feasibility Studies – Informed Decision-Making for Developers

Before committing to a project, you need expert feasibility analysis to assess risks, market demand, and financial viability. Our real estate feasibility studies provide detailed market insights and investment-grade financial projections.

✅ Market & Demand Analysis – Understand competition, demographics, and trends.

✅ Project Viability Assessments – Identify risks and opportunities before breaking ground.

✅ Financial Pro Forma & Cost Estimation – Ensure profitability with accurate forecasting.

📞 Schedule your feasibility study today to minimize project risks!

Real Estate Financial Modeling – Pro Forma & Investment Analysis

Developers need robust financial models to attract investors and optimize project returns. We specialize in real estate financial modeling, providing investment-grade underwriting, cash flow forecasting, and capital structuring.

✅ Pro Forma Development & Underwriting – Accurate financial projections for investors.

✅ Cash Flow & Debt Modeling – Assess long-term profitability and financing options.

✅ Real Estate Cost Estimation & Risk Assessment – Control costs and improve ROI.

📞 Get financial clarity on your development—call now for expert modeling!

Real Estate Capital Advisory – Raising & Structuring Development Funding

Securing capital is one of the biggest challenges for developers. With deep experience in investment banking and private equity, we help structure debt, equity, and syndication strategies to fund your next development.

✅ Institutional & Private Capital Raising – Access investors and financing sources.

✅ Debt & Equity Structuring – Optimize your project’s financial foundation.

✅ Real Estate Syndication Consulting – Build investor partnerships with confidence.

📞 Let’s discuss your capital needs—schedule a consultation today!

Real Estate Property Analysis – Know Your Investment Inside and Out

Before making any investment, you need a clear understanding of a property’s value, strengths, and potential risks. MACRE Properties provides real estate property analysis services to help developers assess properties, compare investment opportunities, and make well-informed decisions.

✅ Accurate Valuation Reports – Ensure you're paying the right price for any property.

✅ Detailed Investment Comparisons – Compare multiple properties with side-by-side analysis.

✅ Profitability Forecasting – See projected cash flow and long-term value appreciation.

📞 Make informed decisions—call us for a consultation today!

Real Estate Analysis for Investors – Smarter Investments, Higher Returns

Investing in real estate requires deep market knowledge and strategic decision-making. Our real estate analysis for investors delivers the insights you need to choose profitable properties, minimize risk, and grow your portfolio with confidence.

✅ Market Trends & Growth Analysis – Identify high-value opportunities in emerging markets.

✅ Portfolio Performance Tracking – Optimize your current investments for maximum ROI.

✅ Personalized Investment Strategy – Get expert recommendations based on your goals.

📞 Secure your next successful investment—book a strategy session today!

Institutional Quality Consulting for

Real Estate Sponsors and Investors

Institutional Quality Consulting for

Real Estate Sponsors and Investors

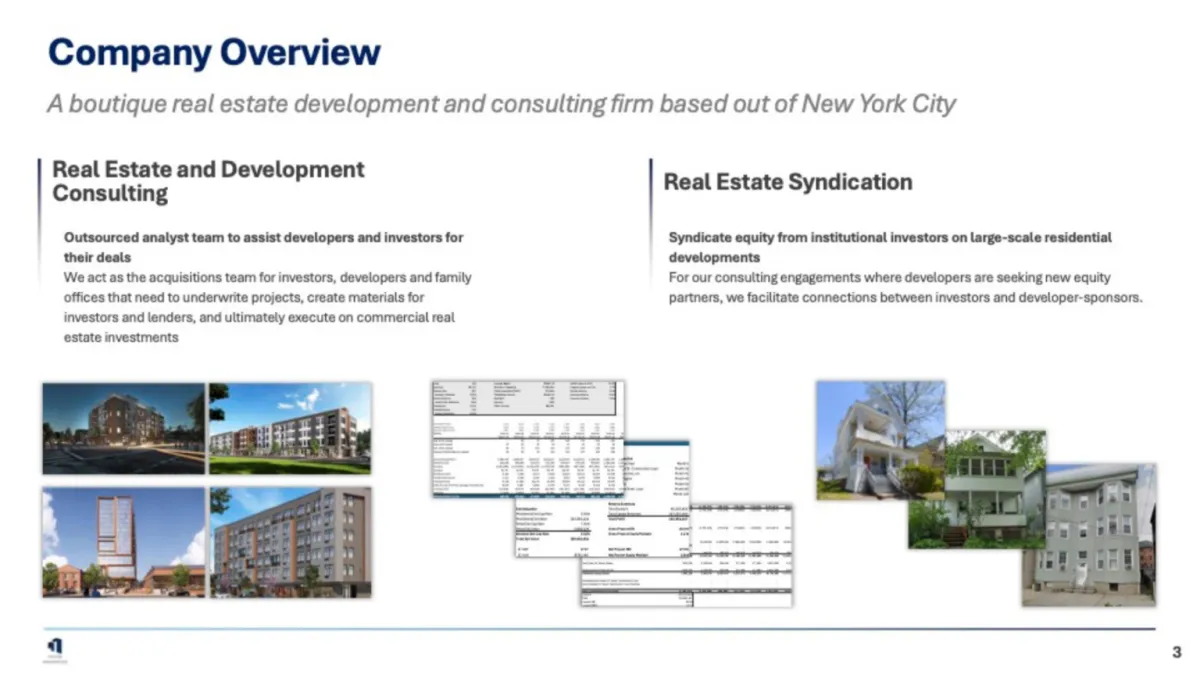

Leverage a team of experienced real estate analysts to assist in your next deal or acquisition

Leverage a team of experienced real estate analysts to assist in your next deal or acquisition

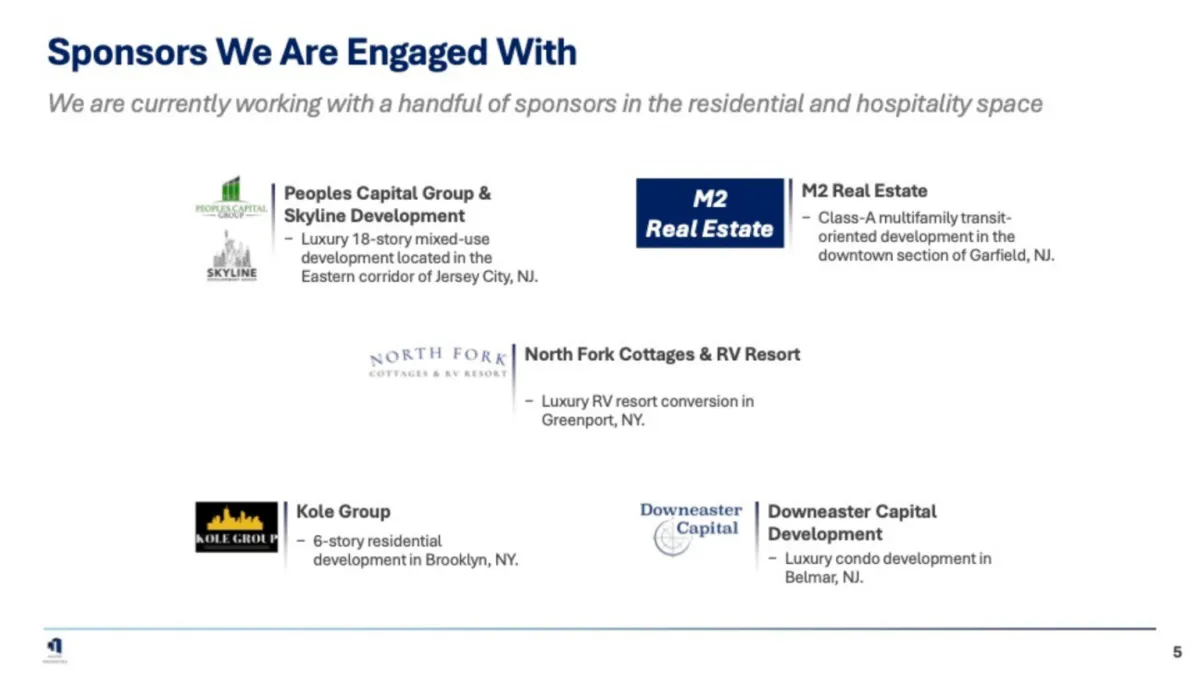

Today we’re working on a spectrum of real estate deals in the multifamily and hospitality spaces, while also assisting several family offices with expanding their real estate portfolios through acquisition consulting.

Today we’re working on a spectrum of real estate deals in the multifamily and hospitality spaces, while also assisting several family offices with expanding their real estate portfolios through acquisition consulting.

Current Projects

North Fork Cottages & RV Resort Greenport, NY

153 Luxury RV Resort Lots and 20 Luxury Cottages

Hospitality

606 Main St. Belmar, NJ

606 Main St. Belmar, NJ

4-Unit Ground-up Luxury Condo with Retail

Mixed-use

67-77 Passaic St. Garfield, NJ

67-77 Passaic St. Garfield, NJ

70-Unit Ground-up Development with 1,000 SF of Retail

Mixed-use

Past Projects

99 Storms Ave. Jersey City, NJ

50-Unit Ground-up Development with 6,200 SF of Retail

Mixed-use

35-37 Sheldon Ter. New Haven, CT

606 Main St. Belmar, NJ

3-Family House, 8 Bedrooms

3-Family House, 8 Bedrooms

Student Housing

224 N 4th Ave. Highland Park, NJ

67-77 Passaic St. Garfield, NJ

2-Family House

2-Family House

Multifamily

176 West Side Ave. Jersey City, NJ

67-Unit Ground-up Development with 6,600 SF of Retail

Mixed-use

417 Communipaw Ave. Jersey City, NJ

606 Main St. Belmar, NJ

420-Unit Ground-up Luxury Highrise with 25,000 SF of Retail

3-Family House, 8 Bedrooms

Mixed-use

About Us

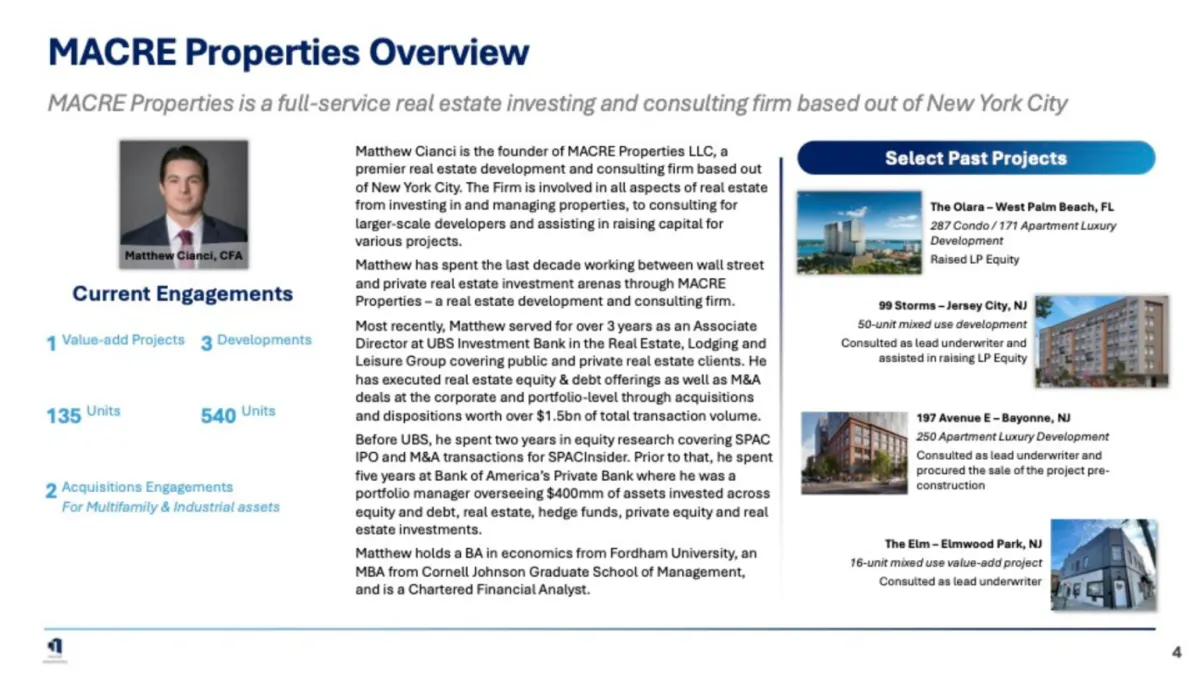

Matthew Cianci is the founder of MACRE Properties LLC, a

premier real estate development and consulting firm based out of New York City.

The Firm is involved in all aspects of real estate from investing in and

managing properties, to consulting for larger-scale developers and assisting in

raising capital for various projects.

Matthew has spent the last decade working between wall street and private real

estate investment arenas through MACRE Properties - a real estate development

and consulting firm.

Most recently, Matthew served for over 3 years as an Associate Director at UBS

Investment Bank in the Real Estate, Lodging and Leisure Group covering public

and private real estate clients. He has executed real estate equity & debt

offerings as well as M&A deals at the corporate and portfolio-level through

acquisitions and dispositions worth over $1.5bn of total transaction volume.

Before UBS, he spent two years in equity research covering SPAC IPO and M&A

transactions for SPACInsider. Prior to that, he spent five years at Bank of

America's Private Bank where he was a portfolio manager overseeing $400mm of

assets invested across equity and debt, real estate, hedge funds, private

equity and real estate investments.

Matthew holds a BA in economics from Fordham University, an MBA from Cornell

Johnson Graduate School of Management, and is a Chartered Financial Analyst.

Matthew Cianci is the founder of MACRE Properties LLC, a premier real estate development and consulting firm based out of New York City.

The Firm is involved in all aspects of real estate from investing in and

managing properties, to consulting for larger-scale developers and assisting in raising capital for various projects.

Matthew has spent the last decade working between wall street and private real estate investment arenas through MACRE Properties - a real estate development and consulting firm.

Most recently, Matthew served for over 3 years as an Associate Director at UBS

Investment Bank in the Real Estate, Lodging and Leisure Group covering public and private real estate clients. He has executed real estate equity & debt offerings as well as M&A deals at the corporate and portfolio-level through acquisitions and dispositions worth over $1.5bn of total transaction volume.

Before UBS, he spent two years in equity research covering SPAC IPO and M&A

transactions for SPACInsider. Prior to that, he spent five years at Bank of

America's Private Bank where he was a portfolio manager overseeing $400mm of assets invested across equity and debt, real estate, hedge funds, private

equity and real estate investments.

Matthew holds a BA in economics from Fordham University, an MBA from Cornell Johnson Graduate School of Management, and is a Chartered Financial Analyst.

Our Simple 3 Step Process

Contact us to schedule your estimate.

Our Roof Specialist will conduct the FREE Estimate.

Schedule a Time for Your New Roof to Be Installed.

It's that simple!

Our Simple 3 Step Process

Contact us to schedule your estimate.

Our Roof Specialist will conduct the FREE Estimate.

Schedule a Time for Your New Roof to Be Installed.

It's that simple!

Hear From Our Clients

I was needing my septic tank pumped out and made several calls to different companies and this was the only one to return my call.

Very courteous and professional and will definitely use again!

Great work and did not leave a mess behind.

I would very highly recommend to anyone! I have used other companies and this one will be my only one from now on!

Great work guys!!!!

★★★★★

Bruce Walker

★★★★★

Bruce Walker

MACRE Properties provided exceptional market analysis that helped us make a strategic investment. Their data-driven insights and risk assessment allowed us to maximize our return while avoiding costly mistakes. Highly recommended!

★★★★★

Bruce Walker

★★★★★

Bruce Walker

As a first-time real estate developer, I was overwhelmed by the process, but MACRE Properties guided me through every step. Their commercial real estate consulting services helped me make informed decisions and stay on budget.

★★★★★

Ian Follmer

★★★★★

Ian Follmer

We needed a comprehensive real estate analysis before purchasing a commercial property. MACRE Properties delivered an incredibly detailed report, complete with valuation insights and risk factors. Their expertise saved us from a bad deal and directed us toward a better investment!

★★★★★

Beverly Johnson

We needed a comprehensive real estate analysis before purchasing a commercial property. MACRE Properties delivered an incredibly detailed report, complete with valuation insights and risk factors. Their expertise saved us from a bad deal and directed us toward a better investment!

★★★★★

Beverly Johnson

FAQ

Why should I hire a real estate development consultant?

Real estate development is complex, with zoning laws, financing, and market risks to consider. We provide strategic planning, feasibility analysis, and financial modeling to ensure your project is profitable and well-structured.

What types of development projects do you specialize in?

We work with multi-residential, hospitality, office, mixed-use, and office conversion projects across the U.S., helping developers assess feasibility, structure capital, and execute deals efficiently.

How can MACRE Properties help me secure funding for my project?

With investment banking experience, we assist in raising capital, structuring equity and debt, and securing private and institutional investment partners.

How much do real estate development consulting services cost?

We offer affordable flat-fee and hourly pricing based on your project’s complexity. Contact us for a custom quote tailored to your development needs.

What’s the first step to working with MACRE Properties?

Simply call us or submit a consultation request, and we’ll assess your project’s needs to create a customized advisory plan.

Get Expert Real Estate Development Consulting – Call MACRE Properties Today!

From feasibility studies to capital structuring, MACRE Properties provides the strategic expertise you need to develop successful projects.

📞 Call now to schedule your consultation!

Contact Us

Call us at: (908) 331-0374

This site is not a part of the YouTube, Google or Facebook website; Google Inc or Facebook Inc. Additionally, This site is NOT endorsed by YouTube, Google or Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc. YOUTUBE is a trademark of GOOGLE Inc.

Digital Marketing by BrandRep